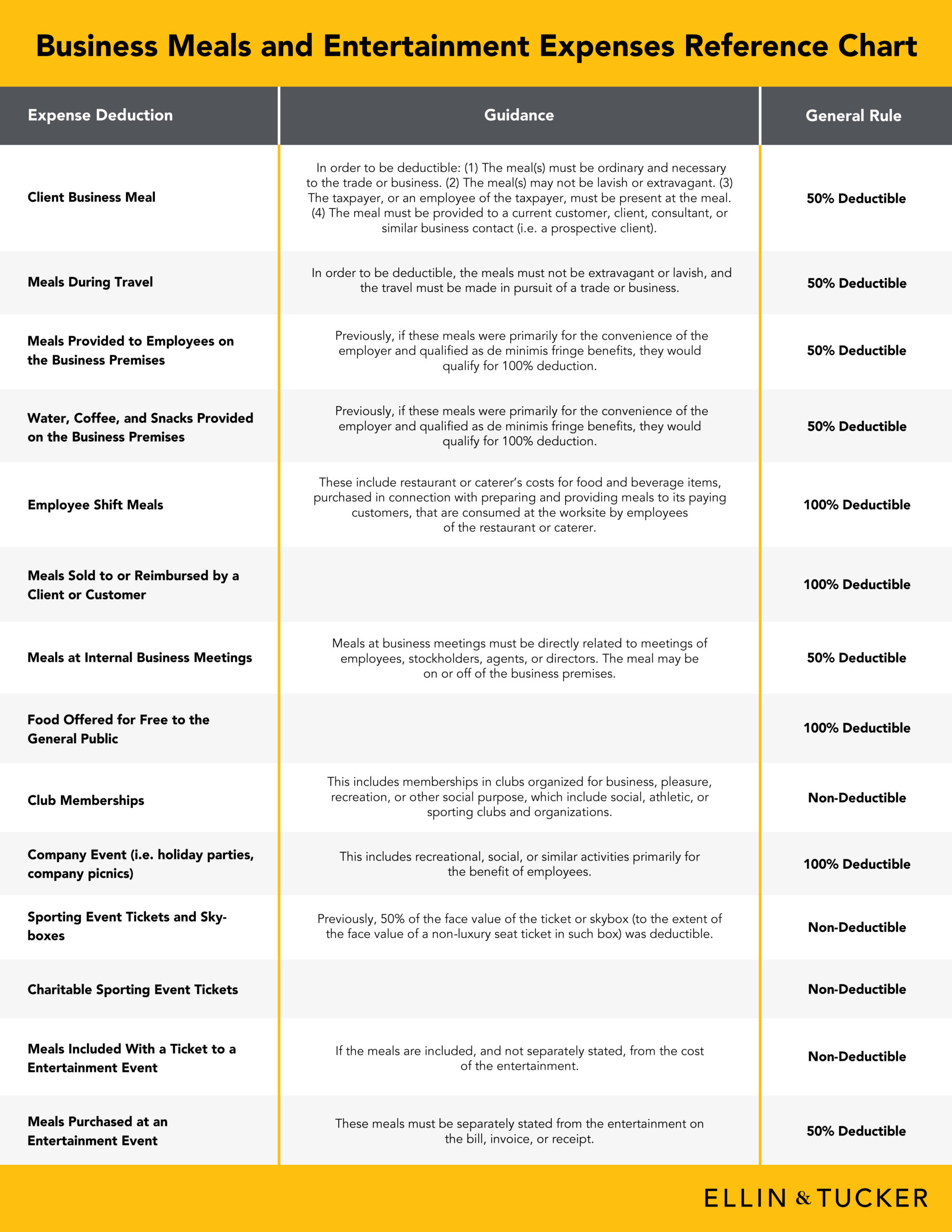

2025 Meals And Entertainment Deduction. Here’s a breakdown of meals and entertainment deductions for 2025 using examples: Which meals and events are now fully deductible?

Check, Please Deductions for Business Meals and Entertainment Expenses, For a checklist of 2025 business meals, entertainment and travel deductibility, go here. A union that’s organizing waffle house workers filed a petition with the labor department on monday, asking federal officials to investigate the iconic chain’s policy of.

2025 Meal & Entertainment Deductions Explained Spiegel Accountancy, The maximum amount you can claim for food, beverages, and entertainment expenses is 50% of the lesser of the following amounts: And with the new financial year beginning soon, taxpayers would again be required to choose.

Expanded meals and entertainment expense rules allow for increased, 2025 meals and entertainment deduction changes: Here are the expenses that qualify for the.

Meals & Entertainment Deductions for 2025 & 2025, If your expenses for luxury water travel include separately stated amounts for meals or entertainment, those amounts are subject to the 50% limit on non. With limited exceptions relating to travel and overtime, the.

Meals and Entertainment Expenses per TCJA Tax Reform TACCT Tax Blog, The 2017 tax cuts and jobs act has left some folks confused about the rules of deducting business meals. If your expenses for luxury water travel include separately stated amounts for meals or entertainment, those amounts are subject to the 50% limit on non.

Meals and Entertainment Deduction 2025, Entertainment allowance is the amount the company gives to employees for their expenses on drinks, hotel stay, meals, movies etc. A guide to meals and entertainment deductions.

Meals and Entertainment Deduction Shay CPA, Which meals and events are now fully deductible? The 2017 tax cuts and jobs act has left some folks confused about the rules of deducting business meals.

Writing off Dining Expense and Food in 2018 Mark J. Kohler, Unfortunately, the trump tax plan cut. Our tax and audit specialists stay on top of meals and.

Meals and Entertainment Deduction 2025 Taxed Right, In 2025, the deductions for meal and entertainment expense reverts back to the tax rules under tax cuts. Entertainment allowance is entirely taxable.

Deducting Meals and Entertainment in 2025 2025 Lifetime Paradigm, Updated on may 31, 2025. 2025 meals and entertainment deduction changes: